Discover the main issues some face with their affiliate payment systems!

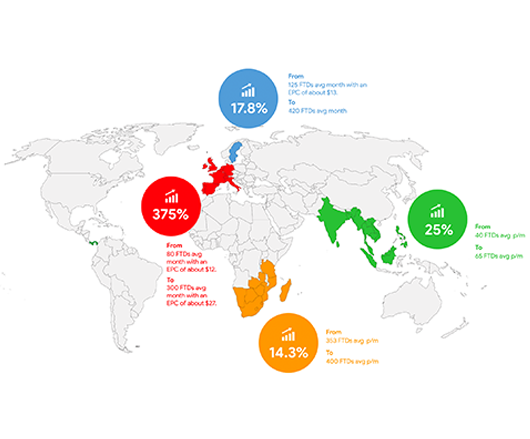

If you ask the more experienced affiliate marketers, they will tell you about the issues they have encountered with affiliate programs over the years. Many of the more common problems they may have come across were likely to include finding brands that can handle a sustainable volume of traffic and target the same GEOs.

More often than not, however, affiliates will encounter issues with their payments. These incidents range from delayed payments to brands outright refusing to hold their end of the deal.

The latter case is often the reason why affiliates tend to ditch affiliate programs and networks alike. Other than that, there may also be issues with the payment solutions themselves.

Discover the most used payment apps and their advantages and disadvantages!

Bitcoin

This payment solution is a well-established tender in the Crypto world and the affiliate marketing industry – and with a good reason. Bitcoin offers a highly secure way to send and receive payments without exposing their identity, which is a reason for concern for many working in online affiliate marketing.

Though this digital currency has had its fair share of ups and downs over the years, it is still a crowd favorite for many publishers or advertisers.

Its biggest advantages include providing a completely anonymous payment system and relatively low transaction costs as it does not work with third parties. The altcoin can also be used for online investments in Bitcoin or other digital currencies.

The disadvantages are the lack of options for chargebacks and refunds, Bitcoin’s high volatility, and topping up the account can be quite expensive depending on your platform of choice.

PayPal

This payment platform needs no introduction.

PayPal is often the first app that comes to mind when someone says quick online payments, and old reliable never seems to fail. Users worldwide use the app either as clients paying for services or business owners for accepting the payments. PayPal provides a foolproof method that keeps everyone happy.

PayPal’s well-known benefits are the fact that the service is available worldwide with few exceptions and the excellent customer service. It is also compatible with almost all Affiliate and ad networks, as well as Facebook Ads. There is further the added bonus of free peer-to-peer transfers.

On the other hand, the downsides entail a limited number of currencies, restrictions on transactions with certain countries, relatively high commissions on cross-transfers, non-flat rates, and you need to connect your bank account and credit card to your PayPal account.

“More often than not, however, affiliates will encounter issues

with their payments, ranging from delayed payments to brands outright refusing to hold their end

of the deal.

”

Paxum

Paxum is yet another well-known eWallet from a company based in Canada, which serves clients worldwide. Designed by webmasters, this app can cater to your specific needs as a business owner in online affiliate marketing.

The eWallet offers flat, straightforward fees, where peer-to-peer transactions only carry a commission of $0.25. There are also plenty of options for sending and accepting payments, including the Paxum prepaid card, which can be used to withdraw funds from any ATM that accepts Mastercard. The commission for each ATM withdrawal is only $2, so that is yet another great advantage.

As for the disadvantages, wire transfers carry a hefty commission at a whopping $50 per transaction. A bank transfer, for that matter, will add the same commission, as well.

The yearly fee for a Paxum prepaid card comes to $44.95 and takes a while to arrive. This is also true for any replacement cards you may need to order.

Skrill

Skrill is also an eWallet, but it has a substantial global presence. The company headquarters are based in London, and the Wallet allows you to send and receive payment with up to 40 different currencies.

Affiliate marketers prefer Skrill to other eWallets thanks to its relatively low fees and high popularity among advertisers. While the withdrawals of funds into your account are commission-free, sending payments carries a commission of 1.9% (up to £20). Signing up is free, and the membership is free as long as you use it every 12 months. Otherwise, Skrill will charge you a monthly fee of £2.

Skrill offers its users a variety of incredible benefits, including a Mastercard prepaid card (£10 onetime fee), low flat costs on bank accounts or visa withdrawals, and so much more.

The downsides, however, consist of being less popular in comparison with other methods such as PayPal and Paxum when dealing with affiliate networks. Additionally, conversion of currencies carries a fee of almost 4% per transaction, which is pretty steep.

ROI Collective: An Affiliate Marketing Network That Empowers Affiliates

Read more of ROI Collective’s fantastic guides to find out which of the other commonly used affiliate tools made the cut!

Become an ROI Collective affiliate and enjoy incredible conversion rates and payouts with us!